A Good Deal of Brexit

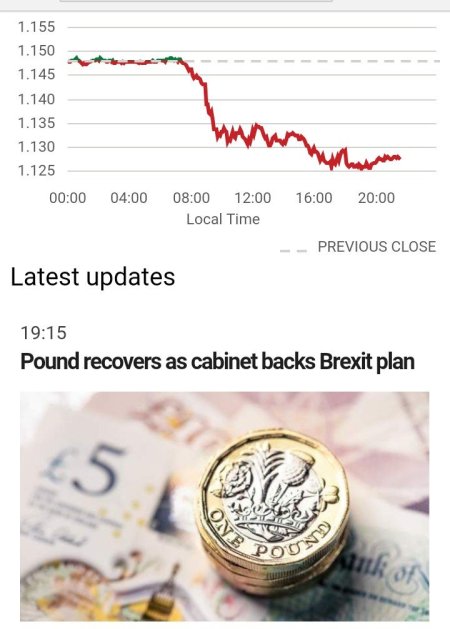

The Irish media were full of Brexit last week, as are the British newspapers this weekend. The prospect of Theresa May’s daft (Shurely ‘draft’? Ed. ) deal being agreed caused a brief spasm of optimism in the currency markets during which the pound soared to the dizzying heights of €1.15 but when it became apparent what a dog’s breakfast the deal is, the £ came right back down again:

Notice that the BBC website article grabbed above (which was published on Thursday evening, 15th November) bears no relation to the reality revealed by the actual data. No change there then.

Anyway, regular readers of this blog will know that I’ve long considered it inevitable that the UK will depart the EU without a formal agreement having been put in place. The last couple of weeks have only strengthened my belief.

Given this, my only hope is that there is another period of false hope during which the pound rises just long enough for me to get a ‘Good Deal’ allowing me to move my savings to Ireland at a decent exchange rate. I missed the blip on Wednesday. I hope there’s another…

Follow @telescoper

November 18, 2018 at 4:24 pm

I’ve long considered it inevitable that the UK will depart the EU without a formal agreement having been put in place. The last couple of weeks have only strengthened my belief.

You’ve cheered me up!

A weak pound would enable Britain to boost exports and become less reliant on the spivs in the City. The regions could then flourish and the grotesque London imbalance be alleviated.

November 18, 2018 at 5:14 pm

I wonder what the UK will be exporting in this dream scenario, and to whom.

November 18, 2018 at 5:21 pm

Under WTO rules tariffs can be little more than the pound is likely to drop, so no change in costs to customers. you surely would be glad to see the City depowered a bit compared to manufacturing in the regions?

November 18, 2018 at 9:57 pm

Tariffs are not really the issue. I just wonder what the manufacturing base will be when overseas investment goes elsewhere as EU companies write UK companies out of their supply chains.

November 19, 2018 at 9:00 am

Why would they do that? Unlike Brussels, companies are motivated by economics, not politics. We were once told that the same would be true if we did not join the euro.

November 19, 2018 at 9:57 am

It’s already happening. In JIT manufacturing one can’t afford to wait for deliveries held for customs checks. Far better to find a supplier inside the EU.

The ‘implementation period’ in the draft withdrawal agreement is primarily to allow EU companies to detach themselves from UK businesses. Naturally the EU will want to make as much as possible for its businesses out of the opportunities the UK is removing from its companies.

November 19, 2018 at 1:07 pm

The amount of trade that Norway does with the EU suggests that this is not a problem.

November 19, 2018 at 1:32 pm

Ahem. Norway is in the Single Market.

Also Norway’s main exports to the EU are energy products, not manufactured items.

November 19, 2018 at 2:03 pm

We can negotiate a Norway deal if we choose with better terms than the present, or a Canada+ one. There is plenty of trade across the EU’s borders. Part of the fun with economic arguments is that both sides make correct qualitative points but are unable to go quantitative and it is the balance of numbers which matters.

November 19, 2018 at 2:33 pm

Well Norway is in the Schengen Area and the main factor in Brexit was keeping the “forrins” out so that’s a non-starter. Which leaves a Canada-type arrangement as the only option.

November 19, 2018 at 10:08 am

Many manufacturers rely on JIT supply chains – with no deal, UK factories will simply be removed from them. Of course one can try to make an argument we will generate new industries to replace these, but it is a leap of faith to claim the benefit from that will outweigh all the job losses coming our way.

Something the politicians don’t seem to get when they quote “the will of the people” is that those same voters will soon turn on them once they lose their jobs.

November 19, 2018 at 1:23 pm

UK as of late refers to: to:https://thecommentarygazette.com/2018/11/19/european-headlines-11-19-2018/

November 21, 2018 at 8:49 am

A weaker pound has very little impact on most exports, as we tend to import raw materials for those exports first.

Services might become more desirable, but leaving the single market cripples the ability to export there. And besides, that would enrich the City even further.

November 25, 2018 at 3:17 pm

It’s very difficult to predict what will happen in Ireland, largely because the `political declaration’ on the future relationship between the UK and EU is so vague.

More surprisingly, perhaps, the UK has effectively ceded sovereignty over Gibraltar, No doubt the PM doesn’t care enough to mind throwing Gibraltar under a bus to save her precious deal.

November 25, 2018 at 4:36 pm

My point was that the Brexiters’s rallying cry of `sovereignty’ is clearly phony: the UK will have no more sovereignty over anything (including Gibraltar) than it had when in the EU, and in many ways a lot less.