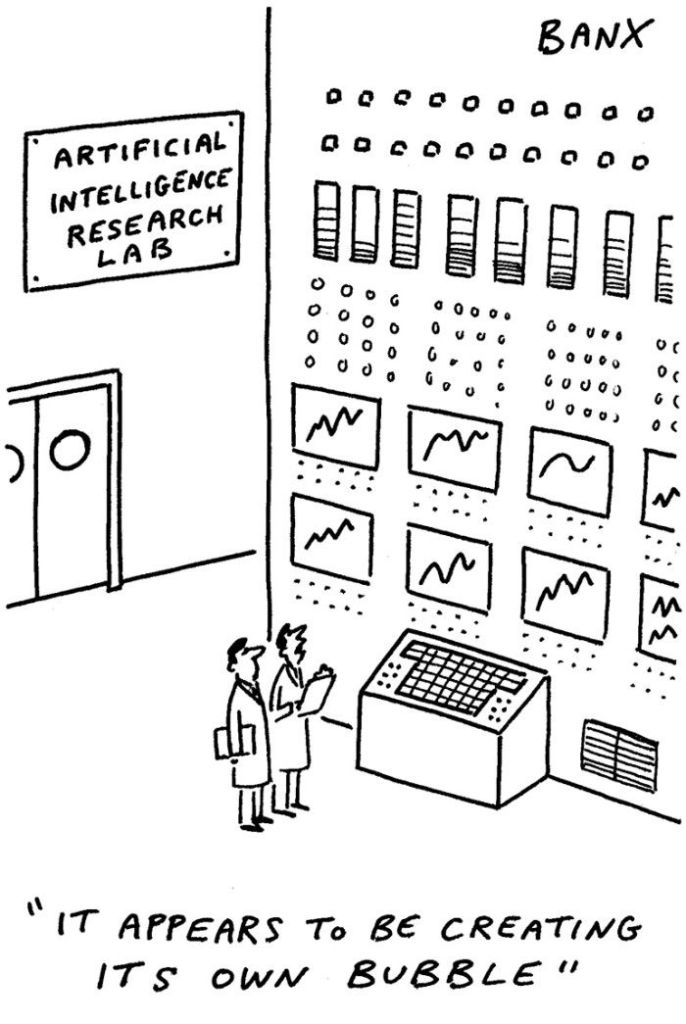

When will the AI Bubble burst?

I’m not a financial expert, but I have noticed a significant number of articles in the media suggesting that the Generative AI industry is a bubble waiting to burst. There are recent pieces here on the BBC website, here in the Financial Times (from which I stole the cartoon), and here in the Irish Times, to name but a few.

These stories are based on reports by the Bank of England and the International Monetary Fund, warning of a stock market crash far worse than the dotcom boom-and-bust of 2000 and even the banking crisis of 2008. Over 30% of the valuation of the US stock market, for example, lies in five big technology companies that are investing heavily in the enormous infrastructure required for AI. Their extravagant capital expenditure is underpinned by a complex series of financial arrangements which could unravel very quickly if the investors get cold feet and consider it unlikely they will see a return on their money. It does look very much like a bubble to me.

My own view is that the claims made about the capabilities of AI by tech gurus are grossly overstated. Only the irredeemably gullible could think otherwise. I think a correction is inevitable. It’s not a question of “if” but “when” and “how much”. I am not competent to answer those questions.

P.S. Now there’s an RTÉ Brainstorm piece along the same lines…

October 12, 2025 at 5:11 pm

I think you are right. There was a jaw-dropping moment when an usually fairly sensible director was in our planning meeting. He suggested using AI to write the javascript update could reduce the estimate to 20% of what had been suggested. The problem was none of the developers doing the update had used the AI suggested at all. When he had left the room, the senior developer of the team said “We will carry on providing estimates based on code being written in usual way”.

October 13, 2025 at 9:35 am

My view is that financial bubbles are often easy to spot, but that it is very difficult to predict when the bubble will burst. There may still be investment opportunities for people wanting to make money in exploiting the continuing inflation of the bubble. The challenge is for them to cash in before the bubble bursts, and that attitude in itself greatly feeds the boom-bust instability.

October 13, 2025 at 2:20 pm

Yes. Timing is everything in financial markets, regardless of whether it is a bubble or not. The other factor for investors is whether a downturn is a minor fluctuation or the start of a major slide.

October 13, 2025 at 10:27 pm

I don’t buy the “bubble” take — sure, valuations look stretched, but AI isn’t just hype: it’s already driving real productivity gains and new business models, so it’s not a dot-com style fad. A pullback could happen, but calling a full collapse inevitable ignores the deep, long-term value companies are building.