It is clear now that the UK Government’s strategy on Brexit is one of economic aggression towards Ireland. Senior Brexiters seem to think that threatening to put up barriers to trade with the Republic will frighten it and the European Union into abandoning the rules of the single market and customs union.

As well as being morally repellent this strategy is also extremely stupid, as is based on a complete misconception of the state of trade between these two countries. For example, one prominent Leave campaigner and former Minister of State recently claimed that 90% of Ireland’s trade is with the UK. That may have been the case in the 1950s but it is certainly not the case now.

In fact, according to the latest figures, only about 11% of Ireland’s exports in goods go to the UK and this figure is falling rapidly. The largest export destination for Ireland within the EU is actually not the UK, but Belgium (11.65%) with Germany just behind on 8.56%. Overall the EU accounts for about 49% of Ireland’s exports; the largest other contribution is the United States on about 29%.

Contrary to popular myth, Ireland’s exports are not dominated by agriculture and food. By far the largest contribution is from chemicals and pharmaceutical products many of which go to Antwerp for onward distribution and/or further processing. This accounts for the large trade figure with Belgium.

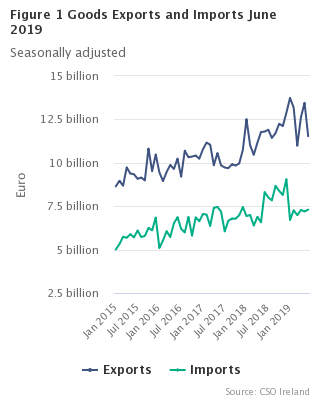

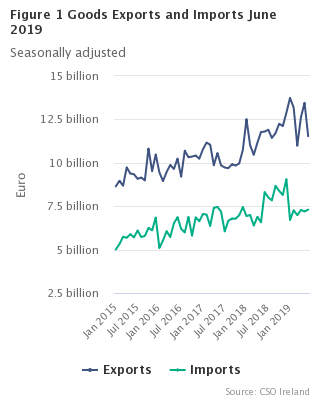

Another fact worth mentioning is that while Ireland overall has a healthy trade surplus overall (it exports more than it imports; see above Figure), its trade balance with the United Kingdom is actually negative (i.e. the UK exports more to Ireland than it imports). In 2018, UK exports to Ireland were worth £38.3 billion; imports from Ireland were £21.9 billion, resulting in a trade surplus of £16.4 billion with Ireland. Ireland accounted for 6.0% of UK exports and 3.3% of all UK imports. Ireland was the UK’s 5th largest export market and the 9th largest source of imports. The UK has recorded a trade surplus with Ireland every year between 1999 and 2018.

Brexiters have frequently used the argument that, since the UK has a negative trade balance with the EU, the EU needs the UK more than the UK needs the EU. It’s a wrong argument, of course, but it’s interesting that the Brexiters don’t apply it to Ireland.

There’s no question that the `No Deal’ Brexit which I’ve regarded as inevitable from the outset will disrupt the Irish economy, or at least parts of it, and in the short term, but I agree with the Irish Times analysis from some time ago and a more recent article from the FT that it will cause far greater damage to the UK.

In the longer term, when the UK is out of the European Union I’m sure its trade surplus with Ireland will quickly disappear as Ireland finds alternative (and more trustworthy) trading partners. Irish businesses are already eliminating British companies out of their supply chains and it seems likely that if and when the hard Brexit arrives, Irish customers will be increasingly disinclined to buy British products.

The UK seems to be hoping that some sort of deal with Trump’s America will help it out of the economic hole it has dug for itself, but remember that the UK currently has a trade surplus with the USA. The Americans will be keen to eliminate that during any future trade negotiations.

The really important thing however is not the overall effect on the economy but on the problems it will cause for communities either side of the British border in Ireland. The recently-leaked documents from Operation Yellowhammer make it clear that the UK government `expects a return to a hard border in Ireland’. The implication of this is stark: the UK government is planning to renege on its obligations under the Good Friday Agreement, which is an international treaty.

If it goes ahead and does that, then it may be that the economic effects of leaving the single market and customs union are small potatoes compared to the price that will pay for becoming a rogue state. I can’t see the United States, with its approximately 40 million citizens of Irish descent, being keen to support a British government that is so obviously seeking to bully Ireland especially, as seems sadly likely, British actions spark a return to violence in the North.